Contents

- 1 Flipkart Axis Bank Credit Card

- 2 Flipkart Axis Bank Credit Card Cashback

- 3 Flipkart Axis Bank Credit Card Features and Benefits

- 4 Axis Bank Flipkart Credit Card Charges

- 5 Advantages of Flipkart Axis Bank Credit Card

- 6 Drawbacks of Flipkart Axis Bank Credit Card

- 7 Should I Apply for Flipkart Axis Bank Credit Card?

- 8 Flipkart Axis Bank Credit Card vs Similar Credit Cards

- 9 Flipkart Axis Bank Credit Card Eligibility Criteria

- 10 How to Apply for Flipkart Axis Bank Credit Card?

- 11 How to Manage Axis Bank Flipkart Credit Card?

- 12 Flipkart Axis Bank Credit Card Review

- 13 FAQs (Frequently Asked Questions)

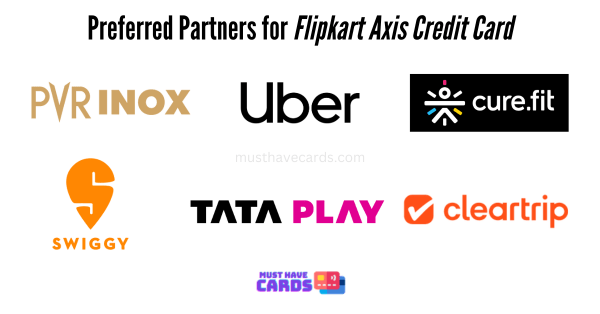

One of the best cashback credit cards in India, the co-branded Flipkart Axis Credit Card is only for customers who regularly shop at the popular online retail website Flipkart. Whether you’re seeking to buy daily household commodities, clothing, electronics, books, or simply pay bills, the Flipkart Axis Bank Credit Card will get you instant 5% cashback on Flipkart purchases. The card also offers accelerated cashback on popular merchants like Swiggy, PVR, Uber, Tata Play, Cleartrip, Cultfit, as well as dining, fuel, and travel benefits.

The Flipkart Axis Bank card also provides free access to domestic airport lounges in India. The card is available for a low joining fee of Rs. 500 + 18% GST and is loaded with features. Read about Flipkart Axis Credit Card to learn more about this card and see where it ranks in comparison to other popular cards, such as the ICICI Amazon Pay Credit Card.

Flipkart Axis Bank Credit Card

Co-Branded

Best for: Cashback

Reward Rate

5%

Joining Fee

₹500/LTF

Annual Free

₹500/LTF

Add-on Card

Free

Flipkart Axis Bank Credit Card Cashback

- On Flipkart shopping, you can get 5% cash back (for Plus Members & Non-Plus Members).

- 4% cashback on Flipkart preferred partners, includes PVR, cult.fit, Swiggy, & Uber.

- 1.5% cashback on all online and offline purchases, including Myntra.

- Purchases on Flipkart (‘Bills and Recharges’ section) will earn you a cashback of 1.5% only (like all other transactions).

- With the Flipkart Axis Bank Credit Card, there are no restrictions on cashback amount earned.

Please be sure that some categories are not eligible for cashbacks. Cashback is not available for certain transaction types, such as fuel expenditures, rental payments, insurance, utility payments, and school fees. Furthermore, you will not receive cashback for purchases made on Flipkart, Myntra, converted purchases to EMI, wallet reload, the purchase of gold items, cash advances, payment of the card’s outstanding balance, and payments to government services.

Flipkart Axis Bank Credit Card Features and Benefits

Welcome Benefits

You’d be eligible for a Rs. 600 Welcome Benefit with this credit card. To be eligible for cashback, you must make a payment of at least Rs. 100 within 90 days of receiving the credit card.

Flipkart Vouchers Worth ₹500

- To receive this benefit, you must make a transaction within the first 30 days of card issuance.

- You will receive an email/SMS from Flipkart with Flipkart gift voucher code.

- This gift card cannot be exchanged for money or credit.

50% off on Swiggy orders

- On Swiggy, you can get 50% off on your first purchase.

- Discount is capped at ₹100 max.

- A minimum cart value of Rs. 129 is required to avail this offer. This offer can be acquired once per cardholder.

Movies & Dining Benefits

- The Axis Bank Dining Delights program gives you 15% off up to ₹500 on dining bills at partner restaurants.

- This offer is valid at over 10,000 restaurants in the entire India.

- PVR tickets are now eligible for an accelerated cashback of 4%.

Travel Benefits

- 4 lounge access each year at select airports in India.

- Earn 4% cash back on Uber rides.

Axis Bank Flipkart Credit Card Charges

Annual Charges

Flipkart Axis Credit Card charges an annual membership fee of ₹500 + 18% GST (Total: ₹590) per year, which is waived off on annual spending of ₹3.5L in the last financial year.

Interest Rates

The interest rate applicable to your Axis Bank Flipkart credit card is 3.6 percent per month or 52.87 percent each year.

Foreign Currency Mark-up Fees

A forex markup fee of 3.5% is imposed on all foreign currency transactions made with Flipkart Axis Bank Credit Card.

Card Replacement Fee

Zero charges for issuing a new credit card if you misplaced/lost your existing Axis Flipkart Credit Card. Add-on Charges are also zero.

Advantages of Flipkart Axis Bank Credit Card

High Reward Rate

Flipkart Axis Bank Credit Card gives an excellent reward rate of 5% flat cashback on all purchases at Flipkart. Apart from Flipkart, you also get a 4% reward rate on spending at partner merchants, including Swiggy, Uber, PVR, and cult.fit.

Unlimited Cashback

Axis Flipkart Credit Card gives you a flat 5% cashback as a reward on each purchase at Flipkart, which will adjusted with the card’s upcoming statement balance each month. There is no upper limit on the cashback amount that can be obtained on the Flipkart Axis Bank Credit Card in a given month. That means it gives you 5% unlimited cashback each month.

Free Airport Lounge Access

Mostly lifetime free credit cards or basic or low annual fee credit cards do not offer free lounge access to their cardholders. However, you do receive four free domestic airport lounge access with your Axis Bank Flipkart Credit Card.

Drawbacks of Flipkart Axis Bank Credit Card

The Flipkart Axis Credit Card comes with a slew of benefits, as well as a few disadvantages.

- Flipkart Axis Bank Credit Card is one of the best credit cards when it comes to shopping on the internet, particularly if most of your purchases are made at Flipkart. The card also comes with 4% savings on online food delivery through Swiggy and Uber. However, if you are someone who enjoys shopping offline at malls or other small retail stores, Flipkart Axis Card might not be the best choice for you as you get a cashback of just 1.5 percent on offline purchases.

- Axis Bank Flipkart Credit Card does not provide any insurance coverage such as travel insurance or coverage for loss/delay of baggage.

Should I Apply for Flipkart Axis Bank Credit Card?

Axis Bank Flipkart Credit Card provides a number of benefits, however it has a few drawbacks.

Apply for Flipkart Axis Bank Credit Card If

- You’re most likely someone who shops online and prefers Flipkart over Amazon for the majority of their purchases.

- Four domestic airport lounge access per year is enough for you.

- You use Swiggy for ordering food and Uber for hailing a cab or renting a car.

Do Not Apply for Flipkart Axis Bank Credit Card If

- If Amazon is your preferred e-commerce platform, you should go for Amazon Pay ICICI Credit Card.

- You are more of a conventional internet shopper. Flipkart Axis Credit Card offers a maximum reward rate of 10% or 4% at select online stores; the reward rate across all offline transactions is just 1.5%.

- Four access to airline lounges per year are not enough for you, or you’d like a credit card with access to railway lounges.

- You want a credit card that offers free accident insurance benefits to the card’s holder.

Flipkart Axis Bank Credit Card vs Similar Credit Cards

Flipkart Axis Bank Credit Card, as we all know, is an online purchasing credit card ideal for Flipkart and Myntra customers. There are other credit cards presently available on the market that offer a more generous reward rate on spending at a specific online partners. Several such credit cards provide neck-to-neck competitors, the Axis Bank Flipkart Credit Card, including the Amazon Pay ICICI Credit Card and the SBI Cashback Credit Card. The comparison table below gives an overall comparison of these credit cards’ features.

| Features | Flipkart Axis Credit Card | Amazon Pay ICICI Credit Card | SBI Cashback Credit Card |

|---|---|---|---|

| Cashback | 5% unlimited cashback cashback on Flipkart spends 4% unlimited cashback on spends at partner merchants, including Swiggy, Uber, PVR and cure.fit. | 5% unlimited cashback for Amazon India Prime members and 3% unlimited cashback for Amazon non-prime members. | 5% Cashback on all online spends including Amazon, Flipkart, Myntra, etc. 5% Cashback capped at ₹5000 every month. |

| Reward Rate | Cashback calculated as 1%=₹1 & adjusted to next month credit card bills. | Cashback rate 1%=₹1 credited as Amazon pay balance next month statements. | Cashback calculated as 1%=₹1 & adjusted to next month credit card bills. |

| Offline Spend Reward Rate | Flat 1.5% cashback | Flat 1.5% cashback | Flat 1% cashback |

| Cashback Cap | Unlimited | Unlimited | Capped at ₹5000 per billing cycle |

| Fees | Joining Fees: ₹500+18% GST Annual Fees: ₹500+18% GST Annual fees waived off on minimum spent of ₹3.5L last financial year | Lifetime Free Credit Card | Joining Fees: ₹999+18% GST Annual Fees: ₹999+18% GST Annual fees waived off on minimum spent of ₹2L last financial year |

| Additional Benefits | 4 Domestic Lounge access per year 20% discount at partner restaurants under Axis Bank’s Dining Delights program | Maximum 15% discount at partner restaurants under ICICI’s Culinary Treats Program. | N/A |

Flipkart Axis Bank Credit Card Eligibility Criteria

You must meet the criteria listed below in order to be eligible to apply for a Flipkart Axis Bank Credit Card. It’s worth noting that a good credit score is necessary to obtain this credit card.

- The primary cardholder’s age should be between 18 and 70 years old.

- The applicants must be residents of India or non-resident Indians (NRIs). NRIs should not be granted temporary visas.

How to Apply for Flipkart Axis Bank Credit Card?

To apply for a Flipkart Axis Bank Credit Card, follow these steps:

- Apply Here: Go to here. This will redirect to official Flipkart website, then navigate to the “Flipkart Axis Bank Credit Card” section.

- Check Eligibility: Review the eligibility criteria to ensure you meet the requirements, which may include age, income, and credit score.

- Click on Apply: Once you confirm eligibility, click on the “Apply Now”.

- Fill Application Form: Complete the online application form with accurate personal, contact, and financial details. Ensure all information is correct.

- Upload Documents: Upload the required documents such as identity proof, address proof, and income proof. This may include Aadhar card, PAN card, salary slips, or IT returns.

- KYC Process: Complete the Know Your Customer (KYC) process. This may involve a video call, submission of additional documents, or a physical visit by a representative.

- Review and Submit: Review the application form to ensure all details are accurate. Finally submit the application.

- Wait for Approval: After submission, wait for the bank’s approval. You may receive updates via SMS or email.

- Receive Card: If approved, the Flipkart Axis Bank Credit Card will be dispatched to your registered address.

- Activate Card: Once you receive the card, follow the instructions provided to activate it, usually through a call or online activation portal.

Required Documents

In order to process your application, you must submit a few documents, including:

- A PAN card is required

- Address proof (Aadhaar card, voter card, driving license, house bills) is a basic requirement for every Indian citizen.

- An Aadhaar card, a voter card, a driver’s license, and utility bills are examples of address proof.

- Proof of income (salary slips or an audited ITR acknowledgment), as well as a supporting letter, is required.

Flipkart Axis Bank Credit Card Limit

The credit limit of a credit card is different for each cardholder, based on their credit score and income. If an applicant has a good credit score, their credit limit will be two or three times their monthly income. Axis Bank Flipkart Credit Card is a entry level credit card offered by the bank. The base credit limit of the card is Rs. 25,000 and can go up to five lacs.

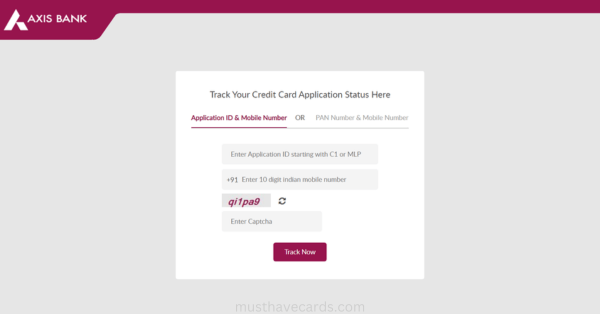

How to Check Axis Bank Flipkart Credit Card Application Status?

After successful submission of credit card application, you may have to wait upto 10-15 working days to process your application by Axis Bank. You can easily track the application status by following steps:

- Open Axis bank credit card tracking website.

- You may track your credit card application either using your Application ID & Mobile Number or using your PAN Number & Mobile Number.

- Choose your method of application tracking, enter the captcha and click ‘Track Now’ button.

- You’ll be able to see status of your credit card application.

How to Manage Axis Bank Flipkart Credit Card?

You may customize your Flipkart Axis Credit Card by registering for internet banking services.

- Visit Axis Bank’s internet banking website.

- If you’re already an Axis Bank customer, simply sign in using your account. Your credit card will be already added there. You can mange it from there.

- If you are not an Axis Bank customer yet, choose ‘First time user’ from the drop-down menu. Select ‘Create Account’ option to complete your registration.

- Register for Axis Bank internet banking with your Flipkart Axis Bank Credit Card.

How to Generate Flipkart Axis Bank Credit Card PIN?

You may get your Credit Card’s PIN online via your internet banking or through Axis Bank’s mobile app ‘Open Axis‘ . You can also contact Axis Bank’s customer service number or visit any of their ATMs to create or retrieve a PIN.

Flipkart Axis Bank Credit Card Review

The Axis Bank Flipkart credit card gives you excellent returns if you like to shop online, and Flipkart is best option for you. Apart from Flipkart, you also receive substantial benefits (4%) with preferred merchants, such as Swiggy, Uber and PVR. Despite not being an entry level card, it offers four free domestic lounge access and dining benefits under Axis Bank’s Dining Delights program.

The Amazon Pay ICICI Bank life time free credit card is the only card on the market that competes with the Axis Bank Flipkart Credit Card. You can even enroll in both, allowing you to select between the two. Before making a decision, you should have comprehensive information regarding the advantages of the two cards.

What are your thoughts on this co-branded credit cards? Which one would you pick between the two? Tell us in the comments area below.

FAQs (Frequently Asked Questions)

What are the key features of the Flipkart Axis Credit Card?

The Flipkart Axis Credit Card offers numerous benefits, including unlimited cashback, discounts on Flipkart purchases, and accelerated reward points on other spends. It also provides exclusive access to airport lounges and insurance coverage.

How can I apply for a Flipkart Axis Credit Card?

To apply for the Flipkart Axis Credit Card, you can visit the official website or use the Flipkart mobile app. Fill in the online application form with your personal and financial details, and submit the required documents. The bank will then review your application and notify you of the status.

What is the eligibility criteria for the Flipkart Axis Credit Card?

To be eligible for the Flipkart Axis Credit Card, you generally need to meet certain criteria such as age, income, and credit score. The specific requirements may vary, so it’s advisable to check the official terms and conditions or contact the issuing bank for detailed eligibility criteria.

How does the cashback feature work on the Flipkart Axis Credit Card?

The Flipkart Axis Credit Card provides cashback on various transactions, including Flipkart purchases. The cashback is credited to your card account and can be redeemed against future transactions. The terms and conditions for cashback may differ, so it’s recommended to review the details provided by the bank.

Can I use the Flipkart Axis Credit Card internationally?

Yes, you can use the Flipkart Axis Credit Card for international transactions. However, it’s essential to check the card’s international usage policy, associated charges, and currency conversion fees. Informing the bank about your travel plans beforehand can help avoid any issues with international usage.